CCUS: The key to making hydrogen energy work today

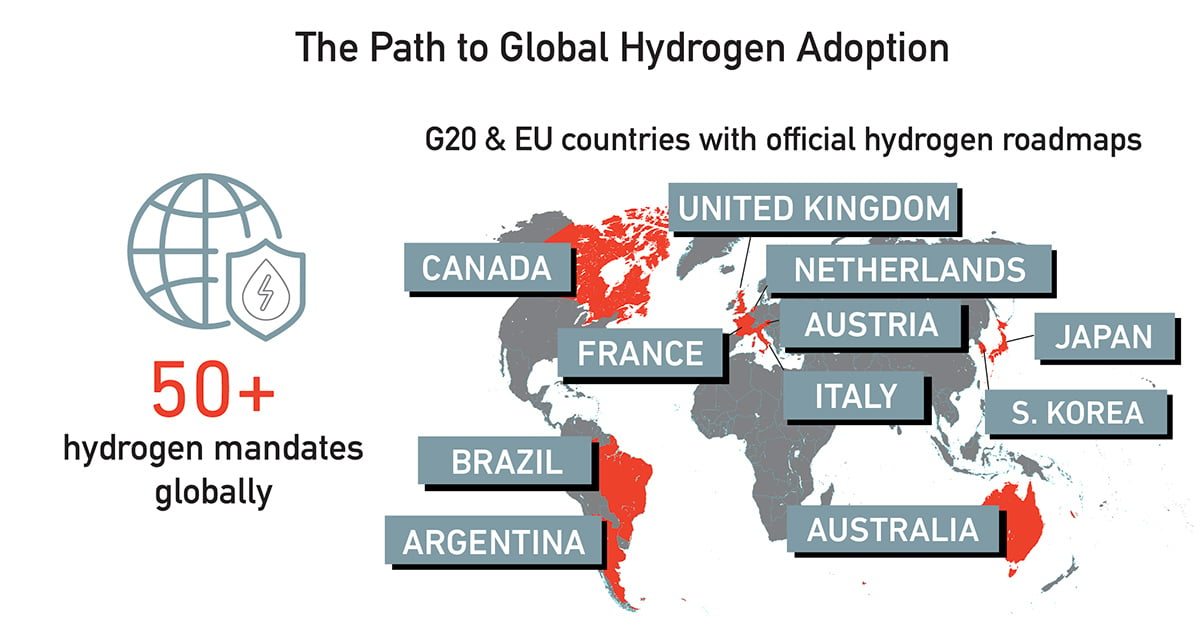

In the drive towards a clean energy future, many leading companies in the energy, industrial and transport sectors have formed business units for hydrogen. Government spending on hydrogen energy research and development is also on the rise, with several countries devising strategies and pilot projects. As of mid-2019, there were over 50 mandates and policy initiatives in place to support hydrogen around the world. Eleven countries across the G20 and European Union have such policies in place. Nine of them have national roadmaps for hydrogen energy.

The reason is clear: Hydrogen offers a solution to lower emissions not only in centralized power generation but also in many hard-to-decarbonize sectors such as steel-making, chemicals manufacturing and heavy duty transport. When pure hydrogen is used as a fuel, the only byproducts are heat and water. When hydrogen is combined with carbon-reliant energy sources to create industrial feedstocks, it lowers the emissions of those feedstocks. Adopted at scale, hydrogen's clean energy potential could put countries on course to achieve the zero emissions future outlined in the 2015 Paris Agreement on climate change.

The Hurdles of a Hydrogen Energy Future

Hydrogen offers tremendous promise as a clean energy solution, yet current production methods -- commonly called 'grey hydrogen' -- rely almost entirely on coal and natural gas. Global annual demand for hydrogen in its pure form stands around 70 million metric tons according to IEA. Meeting that demand with grey hydrogen yields around 830 million metric tons of carbon dioxide annually -- greater than that of Germany, the world's sixth-largest emitter. Therein lies the paradox -- for all of its promise as a clean energy source, current hydrogen production methods are CO2-intensive.

While producing hydrogen from low-carbon energy is costly, there is hope. The declining costs of renewables could reduce the cost of producing hydrogen from renewable electricity -- 'green hydrogen' -- 30% or more by 2030. As production costs decline, the potential exists for hydrogen to play a major role in the energy space going forward. The key determinant will be scale and political will. In a workshop co-hosted by Mitsubishi Power (formerly Mitsubishi Hitachi Power Systems) on the sidelines of the BNEF Summit in London, hydrogen expert Professor Kakaras argues that hydrogen technologies are already commercially available but reduction of production costs are still necessary.

Regulated charges on electricity tariffs should be removed to lower hydrogen production costs. Regulations also currently limit the development of a hydrogen industry. In some cases, regulations around the uses of hydrogen are unclear, while the requirements to secure permits are inconsistent across sectors and countries. Likewise, important standards around safety measures, cross-border sales and more have yet to be agreed. In turn, this prevents investment in the critical infrastructure needed to make hydrogen energy a reality.

From Grey to Blue to Green

While green hydrogen will likely remain a challenge for the next decade requiring more renewable electricity to be dedicated for its production, 'blue hydrogen' is a realistic step in that direction. By combining conventional production methods with carbon capture technology, blue hydrogen is delivered almost carbon free.

Steam Methane Reforming (SMR) -- the most widely-used technology for hydrogen production from natural gas -- is likely to remain the dominant production technology in the near term due to favorable economics. The addition of Carbon Capture, Utilization and Storage (CCUS) technology to SMR plants can effectively neutralize emissions from hydrogen production. The result is blue hydrogen.

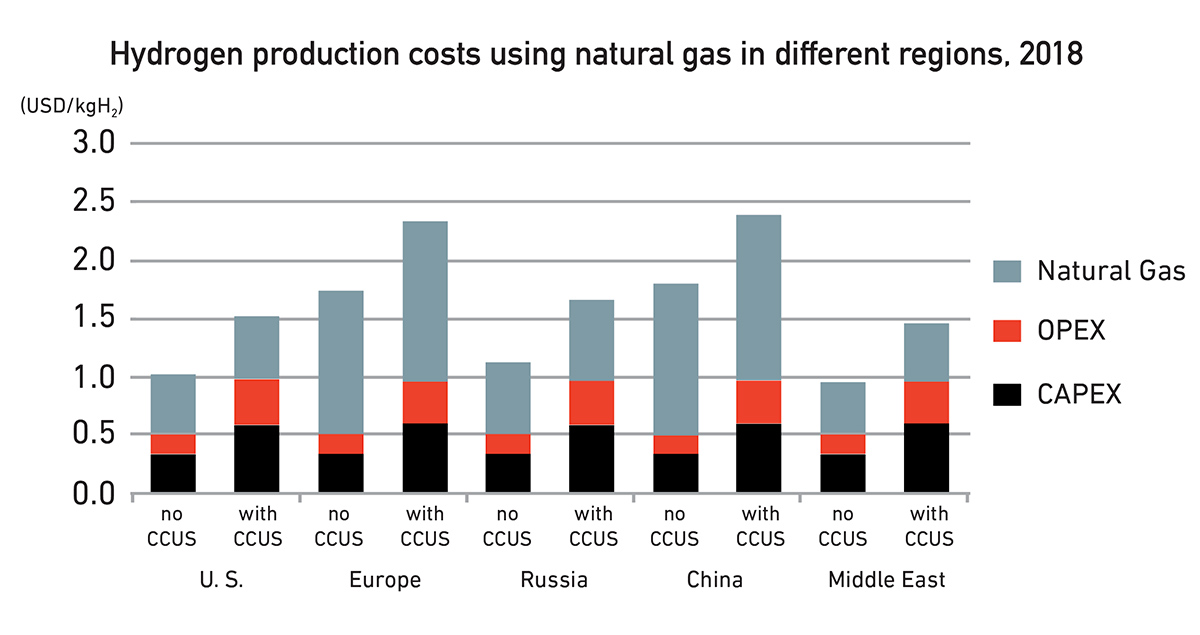

In a recent IEA study, it is already highlighted that hydrogen production from natural gas with CCUS is just a bit more expensive than grey hydrogen. Yet, as the price of CO2 emissions increases and CCUS technology becomes cheaper, the price gap will narrow in coming years making blue hydrogen ever-more competitive.

As the world moves towards green hydrogen, CCUS technology can serve as a much-needed blue-hydrogen stepping stone. At the same workshop at the BNEF Summit, Kakaras makes a case for how the scale of CCUS can benefit hydrogen production. "The capture plant installed on an existing power generation plant at Petra Nova has a capture capacity 2.5 times more than the capture needed to make blue hydrogen at Europe's largest hydrogen production site." This is a case in point that post-combustion carbon capture is worth exploring, to deliver carbon-free hydrogen at the needed scale. Mitsubishi Heavy Industries Group delivered the world's largest commercial scale carbon capture plant for Petra Nova in Texas, USA, which has been under successful commercial operation since 2016. Applied to hydrogen production, the proven CCUS technology can turn grey hydrogen to blue hydrogen for a greener future.

Get MHI Group's ebook on hydrogen's role in the energy transition Hydrogen: The Next Step in Energy Evolution