Pipes, ports and electrolyzers: Europe’s hydrogen future

As the hydrogen debate shifts from talk to action, Europe is laying the infrastructure foundations of a future supported by hydrogen.

This versatile energy carrier has been billed as “an increasingly important piece of the net zero emissions by 2050 puzzle” by the International Energy Agency (IEA), one that can help resolve some of our critical energy challenges.

But while Europe has the capacity to produce both clean “green” hydrogen and its derivative ammonia, much of the continent’s future demand will need to be met through imports.

To that end, a number of major infrastructure projects are in progress across the continent.

Home-grown hydrogen capacity

Hydrogen accounted for less than 2% of Europe’s energy consumption in 2022 and 96% of that was produced using fossil fuels. However, things look set to change.

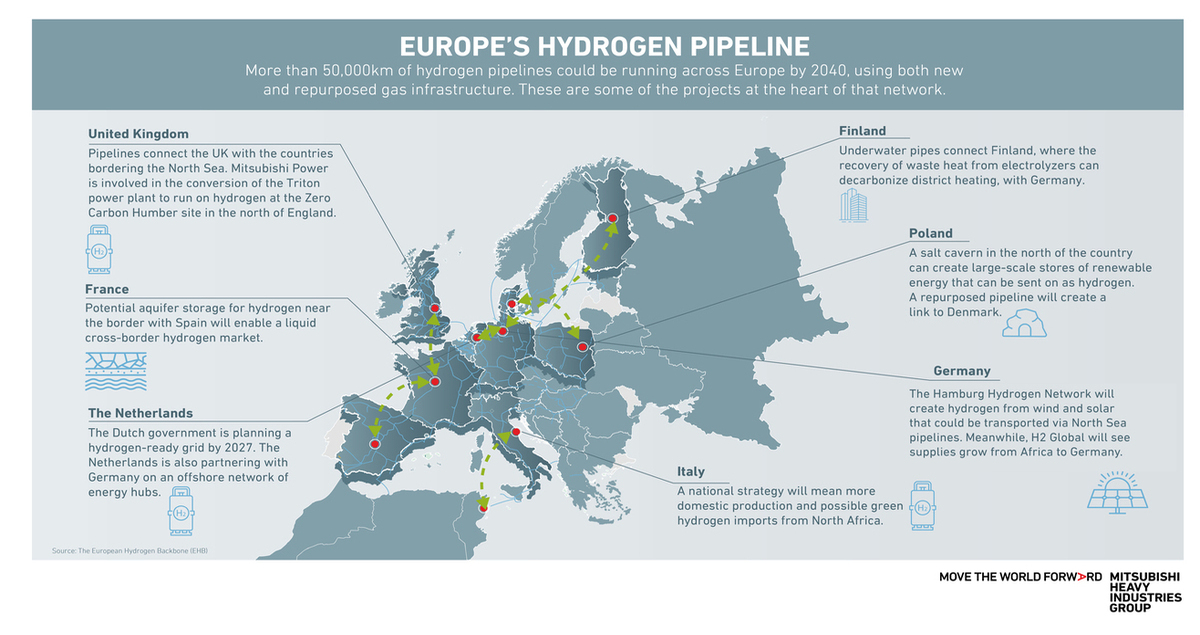

The European Hydrogen Backbone report lays out a proposed, dedicated hydrogen transport network spanning 21 countries, which could see up to 53,000 kilometers of hydrogen pipelines in place by 2040. More than 60% of this planned network would repurpose existing natural gas infrastructure.

As part of the EU’s hydrogen strategy and REPowerEU initiative, scaling up green hydrogen has become a priority, with the aim of producing 10 million tonnes and importing a further 10 million tonnes by 2030.

Sustainable hydrogen from electrolyzers powered by renewable energy is an emissions-free fuel, which can help decarbonize hard-to-abate industrial sectors and heavy transport.

“It's a zero carbon fuel so it can deliver flexibility around the clock at a zero carbon footprint. And, at the same time, it's what we call the most reliable and long duration for seasonal storage. So these two qualities of hydrogen are the ones that are now delivering the surge of hydrogen,” Professor Dr. Emmanouil Kakaras, Executive Vice President NEXT Energy Business at Mitsubishi Heavy Industries EMEA explained at the recent BNEF Summit 2023 in London.

Alongside hydrogen, ammonia can be used as a carbon-free energy source. There are 32 ammonia production sites scattered across the EU, with a combined potential capacity of 17.7 million tonnes or around 10% of global production.

However, ammonia is currently produced from gray hydrogen, using fossil fuels as a feedstock, and is primarily used for fertilizer and chemical production. Therefore, a major transition would be required to repurpose these sites for the production of clean ammonia as a hydrogen carrier.

EU-wide project pipeline

While these resources are substantial, Europe’s growing clean energy needs mean it will likely be reliant on clean hydrogen and ammonia imports from places like the US and North Africa.

In preparation, several import and generation infrastructure projects are in the development pipeline.

Belgium aims to become a hydrogen gateway, with plans to ready ports like Antwerp-Bruges for massive amounts of green hydrogen imports. The country has already signed a Memorandum of Understanding with Chile to import clean hydrogen and its derivatives from the South American country.

Across the North Sea in Scotland, a purpose-built marine pipeline has been proposed as part of the Net Zero Technology Centre’s Hydrogen Backbone Link project.

This critical infrastructure would help Scotland meet ambitious green export targets by piping green hydrogen into northern Europe, which could supply up to 10% of the continent’s projected hydrogen imports by the mid-2030s.

Meanwhile, in Germany, a consortium of seven energy firms is planning to transform the country’s only deep-water port at Wilhelmshaven into a 10GW green hydrogen hub by 2030.

The project is set to replace the natural-gas-generated gray hydrogen used in German heavy industry, with green hydrogen generated using renewables like wind and solar. An ammonia import terminal and a 1GW electrolysis plant for producing hydrogen will be constructed, capable of supplying approximately 300,000 tonnes of hydrogen.

A pipeline link has also been proposed between Wilhelmshaven and the city of Cologne, where several large chemical companies could become hydrogen offtakers.

Policy, scale and a global outlook

Actioning ambitious plans rests on policymakers developing an equally ambitious policy framework.

Legislation like REPowerEU contains sizable support for hydrogen, and the IPCEI Hy2Use and Hy2Tech projects unlock a combined €10.6 billion for hydrogen-related projects.

More recently, the announcement of a multi-billion-euro Hydrogen Bank aims to provide finance to scale the EU’s hydrogen ecosystem, but more needs to be done according to Maria João Duarte, EMEA Representative to EU institutions at Mitsubishi Heavy Industries.

“Despite a lot of groundwork already accomplished, European Union policymakers still have an urgent need — and significant opportunities — to go further and faster to create a hydrogen economy,” she says.

Many of the policies, targets and regulations required to develop a working EU hydrogen market are already in place.

Duarte concludes: “Simplicity and speed are required to get the entire global value chain ‘singing from the same hymn sheet’.”

Learn more about Mitsubishi Power's latest success 30% hydrogen co-firing