Japan’s Green Transformation strategy: Boosting industrial decarbonization

Funding the energy transition doesn’t come cheap. Unsurprisingly, securing finance sits at the heart of efforts to develop and scale the nascent technologies that will “green” global energy systems.

To that end, Japan published the world’s first sovereign climate transition bond in February 2024. Called the Japan Climate Transition Bond, it is part of the country’s wider energy transition or green transformation (GX) strategy, aimed at boosting public and private spending to bolster the deployment of clean industry solutions.

It’s an initiative intent on developing technologies like hydrogen and ammonia supply networks, carbon capture, utilization and storage (CCUS), synthetic fuels and next-generation nuclear reactors — to attract the investment needed for industry and society to decarbonize.

Transition finance boom

Transition finance is specifically designed to help carbon-intensive projects that are aiming to reduce emissions in line with global efforts to embrace more sustainable operations, but that may not qualify for more established green bonds.

Japan’s government will issue 20 trillion yen ($133 billion) in transition bonds over the next decade, throwing the emerging global market wide open. Such exponential growth is huge compared to the $7 billion raised since 2020.

Leveraging those transition bonds, policymakers in Japan aim to attract total private and public spending worth up to 150 trillion yen ($1 trillion) to deploy the solutions needed to achieve decarbonization goals.

This form of finance can help build investor confidence in emerging energy transition technologies, reassuring investors who are often skeptical of new solutions overpromising and under-delivering.

Japan’s GX strategy

Instigating new methods of transition finance is one of the key initiatives to realize Japan’s GX strategy, which plans to reduce emissions while maintaining and even enhancing the country’s economic competitiveness.

Other vital initiatives include a growth-oriented carbon pricing system and an integrated regulatory framework that directs government funding from its transition bonds to stimulate private investment.

There is also an international development strategy that includes instigating the Asia Zero Emissions Community as a cooperation platform to help partner countries in Asia achieve their energy transition goals.

And, finally, plans are in place to develop the GX League of 550+ Japanese companies committed to voluntary emissions reductions, supply chain decarbonization and promoting green procurement.

The overall GX plan will rethink Japan’s future energy mix, transport system, industry and building sectors.

Developing a hydrogen network, for example, could help decarbonize a range of industries, such as power generation and transport. Japan’s strategy includes a commitment to expanding ammonia and hydrogen co-firing and establishing 100% firing by 2030.

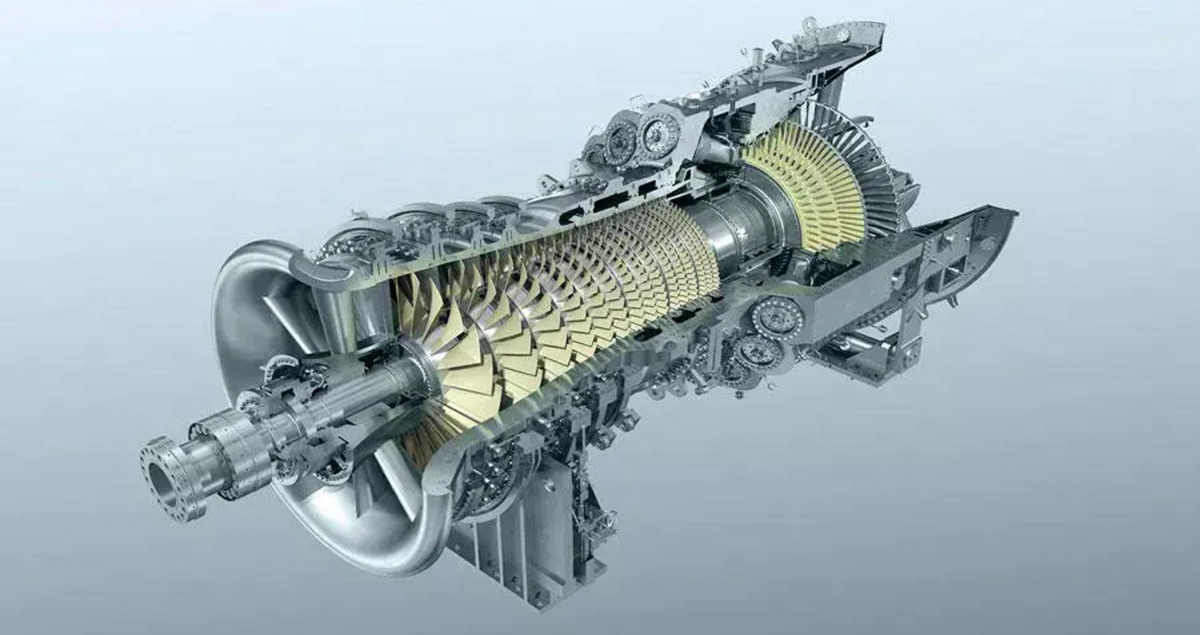

Having successfully tested a 30% hydrogen and natural gas fuel blend, Mitsubishi Power, a power solutions brand of Mitsubishi Heavy Industries (MHI), is working on a 100% hydrogen-firing demonstration of power turbines at its Takasago Hydrogen Park test facility.

Scaling energy transition solutions

CCUS forms another core component of Japan’s plans to curb power sector emissions, targeting CO₂ capture and storage (CCS) capacity of 120-240 million tonnes by 2050.

This technology is vital to help hard-to-abate industries, like steelmaking, decarbonize — Japan’s GX strategy aims to reduce steelmaking CO₂ emissions by 30% compared to 2013 levels, as well as produce 10 million tonnes of green steel by 2030.

MHI has pioneered a variety of technologies aimed at building CCUS value chains for a wide range of industries. These include its proprietary KS-21 capture solvent, used in the Advanced KM CDR Process; developing compact CO₂ capture systems “CO₂MPACT”; and liquefied CO₂ carriers to transport captured CO₂.

Meanwhile, MHI issued JPY 10 billion five-year transition bonds in September 2022 and August 2023, totalling JPY 20 billion.

Kimiyo Hirowatari, Manager of the Financial Planning Division at MHI, made the case for this new asset class to the audience of an OECD panel session at COP28, titled ‘Unlocking Capital For Net Zero in Asia and Beyond’.

The MHI Group will use transition financing to strengthen its energy transition activities and drive its growth strategy which will lead to providing real solutions to hard-to-abate sectors, like chemical, steel making, and power companies.

Technological readiness must be complimented by finance initiatives and regulatory frameworks to achieve scalability in a cost-efficient manner, says Hirowatari.

“We can be technology ready, but implementation at scale, at a reasonable cost, is another thing,” she said.

Japan’s GX strategy could provide targeted support mechanisms to accelerate innovation and development of earlier-stage technologies while encouraging the deployment of mature ones in a way that balances decarbonization, affordability, competitiveness and security concerns.

Discover more about MHI’s new GX Solutions Business Domain to promote energy transition