There’s a revival in US manufacturing - But not where you may expect.

Carnegie, Ford, Rockefeller; it would be remiss to talk about America’s rise to global economic dominance without mentioning the manufacturing tycoons who drove it. Yet the America they knew, the America they helped build, has changed.

Over the last quarter of a century, the US manufacturing sector has seen its fortunes decline. As companies followed the lure of cheaper labor and lower tax rates in emerging markets, over five million jobs were lost, especially in America’s industrial heartland, the Midwest.

Reversing the contraction of the US manufacturing sector was a major focus in last year’s presidential campaign, and one of the first priorities for the new administration as it took office.

Against this backdrop, it is easy to overlook the fact that a US manufacturing turnaround is already under way.

Silver linings

The National Association of Manufacturers reports that between 2009 and 2016, the contribution of manufacturing to the US economy grew from US$1.70 trillion to US$2.18 trillion. For every dollar spent in manufacturing, another US$1.81 was added to the economy.This is the highest multiplier effect of any economic sector.

Manufacturing has also created over 800,000 jobs, and will need to fill 3.5 million more over the next decade. According to Deloitte, the US is also expected to take back the number one slot for manufacturing competitiveness by 2020 – improving from fourth in 2010.

Add to this the government’s focus on reviving the sector and it is not surprising that there is renewed confidence in the US as a manufacturing location. A case in point: Ford recently cancelled a US$1.6billion investment in Mexico in favor of putting the funds back into its US operations.

Shaking off the midwestern rust

According to a survey by Forbes, the sector’s resurgence has enabled some of the large manufacturing cities in the Midwest to regain some of their former glory.

The biggest winner was the Grand Rapids area of Michigan. Defying the Midwest’s ‘Rust Belt’ label, it boosted its industrial workforce by just under a third between 2010 and 2016. Jobs were created across a broad range of sectors including automotive parts, food, aerospace and defense, and manufacturing now makes up over a fifth of jobs locally. Unemployment, which was at a high of 13% in 2009 dropped to under 3% last year.

In Louisville/Jefferson County, on the border of Indiana and Kentucky, the industrial workforce expanded by more than a quarter between 2010 and 2016, placing Louisville third in the ranking. 12% of local employment is in now in manufacturing. Again, the area benefits from diverse industries, with its biggest employers covering car making, appliances, printing and beverages.

Mitsubishi Heavy Industries’ turbocharger and climate control facility in Franklin, Indiana, is located close to this area. It also happens to be within driving distance of another major manufacturing hub, the Cincinnati area.

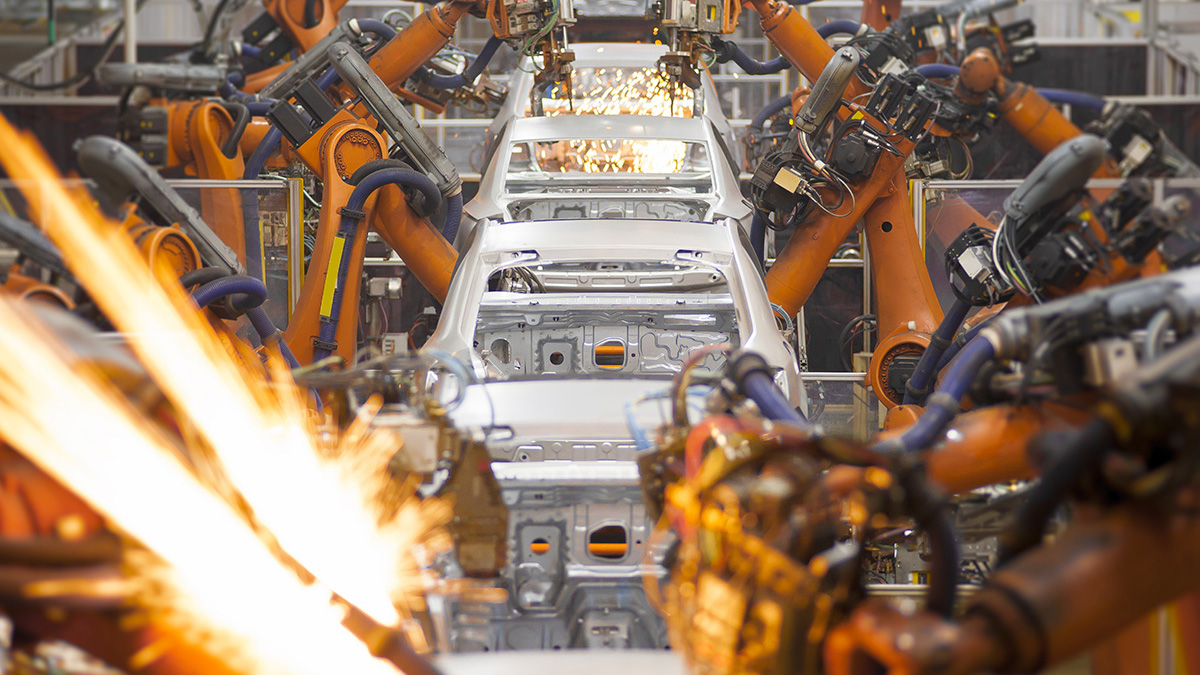

Cars are driving the recovery

A lot of the top-performing areas were buoyed by car sales, which have reached record levels in recent years and become a major driver of the US manufacturing revival.

The area around Detroit - the traditional hub of the American car industry – has benefited substantially as a result. Across the conurbations of Detroit-Dearborn-Livonia and Warren-Troy-Farmington Hills, employment surged by 30% and 27% respectively.

Yet it’s not just down to cars. Despite Asian manufacturers’ dominance in electronics, some of America’s high-tech hubs along the West Coast saw improvements, including San Diego-Carlsbad (California), Denver-Aurora-Lakewood (Colorado) and the Portland-Vancouver-Hillsboro area crossing the Oregon-Washington state border. Even Silicon Valley experienced a small uptick in manufacturing employment between 2010 and 2016.

While some manufacturing hubs are getting back on track, two of the country’s largest centers for industrial jobs have continued to decline significantly: Chicago, which has seen its steel and metal-making industries move to lower-wage locations, and Los Angeles-Long Beach, where employment has been lost across aerospace, design and specialty manufacturing.

Small is beautiful

A very different picture of US manufacturing emerges when you include small and medium-sized cities.

In fact, 19 out of the top 20 cities creating manufacturing jobs fall into this category. Grand Rapids is the first large city to rank, coming in at number 20. This suggests that smaller cities rather than their larger rivals have become the key engine of recovery – somewhere few people would look for a manufacturing revival.

San Rafael in California tops the list. A year-on-year increase in jobs of close to 14% saw it jump three notches in the 2016 ranking – bucking the downward trend set by some of its Californian neighbors.

Savannah, Georgia – another major hub for Mitsubishi Heavy Industries in the US - improved by 24 places year-on-year to come second.

In third place, the area around Portsmouth on the New Hampshire-Maine border, with fewer than 80,000 inhabitants, improved by a whole 35 places.

Closing the gap

With a recovery already under way, it’s important that the US – federal and local government, employers and the education sector – get the mix right to create a manufacturing-friendly environment.

The US has all the basic assets it needs to fuel a manufacturing renaissance. But with two million jobs set to go unfilled over the next 10 years, it needs to bring technology, people and skills together in the right places.

And where Asia may have been seen as a threat in the past, Asian-based companies including Mitsubishi Heavy Industries are adding their expertise to the mix, investing in the US market and creating new job opportunities across the country.