Hydrogen production: Is it better to go green or blue … or green and blue?

Hydrogen is one of the main pathways for the energy transition. So far, few experts, policymakers, multilaterals and industry players would disagree. But the question of how to produce the enormous amounts needed to achieve this is polarizing hydrogen’s advocates.

There is expected to be a sevenfold rise in hydrogen demand by 2050. About 660 million tonnes a year will be needed to decarbonize power, industry and transport, and store excess renewable electricity.

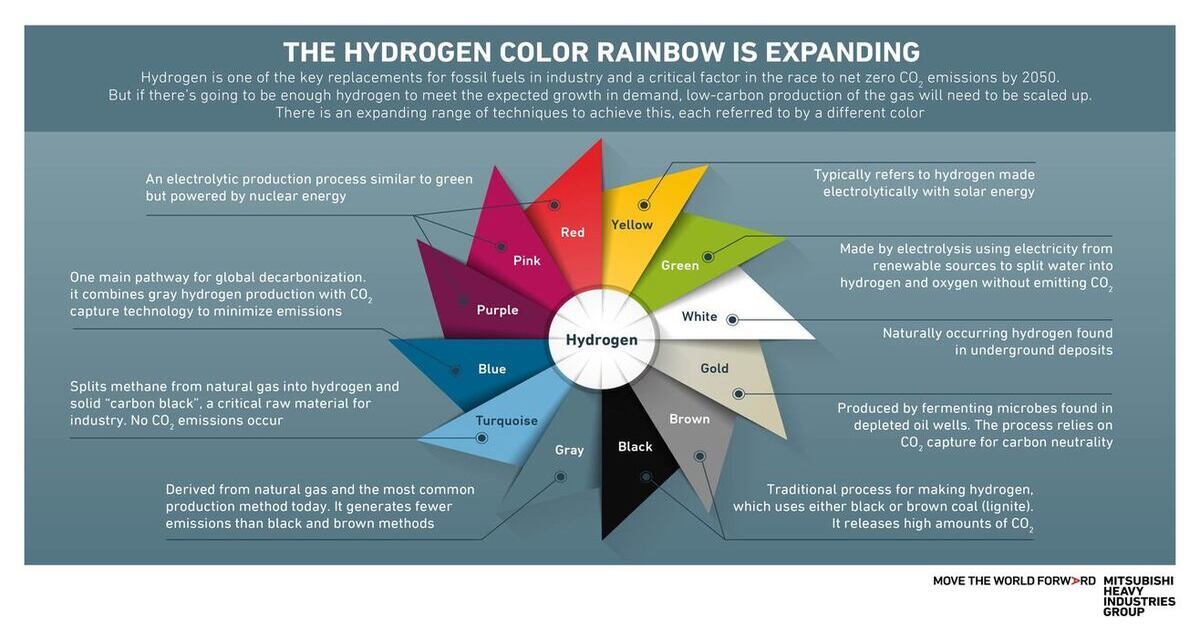

The majority of hydrogen today is produced using fossil fuels. But there is now a wide range of carbon-free and low-carbon production methods for hydrogen. Two of the most hotly debated contenders are “green” and “blue” hydrogen. And advocates typically fall into one or the other camp.

However at the recent FT Hydrogen Summit, Professor Emmanouil Kakaras, Executive Vice President of NEXT Energy Business at Mitsubishi Heavy Industries (MHI) EMEA, challenged this distinction.

“As a general principle—and as an engineer with no theological preferences—I will stick to the full range,” he said. “All hydrogen types are good, as long as they are documented to be carbon-free.”

What are blue and green hydrogen?

Green hydrogen is produced by electrolysis powered by renewable energy sources. Solar or wind power are used to split water molecules into their constituent parts: hydrogen and oxygen. As the above graphic says, this process is entirely CO₂-free.

Blue hydrogen uses the traditional “gray” method of reforming natural gas but captures the resulting CO₂ emissions before they hit the atmosphere. The sequestered carbon dioxide is either condensed and stored underground, or can be used as a feedstock for various industrial applications, such as in the food and beverage sector.

Is green or blue better?

Blue hydrogen can produce low-carbon hydrogen at scale to help decarbonize hard-to-abate sectors such as transportation. Currently, it is also significantly cheaper than green hydrogen.

But it does depend on natural gas, which has been subject to high price volatility and geopolitical turbulence. What is more, some people fear that CO₂ capture, utilization and storage (CCUS) might perpetuate the use of fossil fuels at the expense of shifting to renewable energy as rapidly as possible.

Much less than 1% of hydrogen is produced by electrolysis and therefore considered “green”. While electrolyzers are a mature technology used in many other chemical processes, production costs for green hydrogen can still be high compared with those using fossil fuel technologies.

The industry must bring down this cost. A significant factor is having access to low-cost renewable electricity, and this varies from one region to the next. Moreover, green hydrogen production needs to scale up to become more economical.

Projects and investment pledges have ramped up all over the world that could ultimately change the economics of green hydrogen, with strong policy support from bodies such as the European Commission and an expanding rollout of renewable energy plants.

The future of hydrogen is blue and green

The global pipeline for electrolyzers reached 340GW in February, with 200GW of this in Europe, according to industry analysts Aurora. They expect scaled-up electrolyzer use to bring down the cost of green hydrogen to that of blue by the 2030s, with Norway, Spain and the UK having the lowest costs thanks to their high renewable capacity.

However, the most attractive places to produce electrolytic hydrogen will be in countries with abundant, low-cost renewable resources. These include the Middle East, Africa, the United States and Australia.

But to get to the 660 million tonne a year target, both the Intergovernmental Panel on Climate Change and the International Energy Agency have highlighted the crucial role of CCUS in reaching net zero.

Similarly, the EU Hydrogen Strategy acknowledges the need for blue hydrogen as a transitional technology while electrolytic production ramps up.

Countries such as the UK are pursuing a twin-track approach to hydrogen. This includes blue production methods in projects including the Zero Carbon Humber cluster. The gas will be used directly by local industry – including at a combined heat and power plant that Mitsubishi Power will convert to run on hydrogen instead of natural gas, and at a new power station that will run entirely on hydrogen. Four industrial sites in the UK have been identified for electrolytic hydrogen production, too.

The long-term winner will be green hydrogen

As Professor Kakaras argued at the FT Hydrogen Summit, no color of hydrogen should be neglected in the battle against climate change, especially given the compound importance of hydrogen as a fuel and a storage medium for renewable energy.

The great turbulence in the global energy market this year also means now would not be a good time to disregard any technology that might play a vital role over the next 20 or 30 years, he said.

However, Professor Kakaras added that this balance would eventually shift. “In the long run, green hydrogen will definitely be the winner because we cannot decarbonize a world without an abundant investment in renewable capacities,” he said. “But we have to get there. And so, we also need blue.“

Discover more about MHI’s work in clean fuels