Electric and combustion engines race for efficiency

Will there be only one survivor in the battle between electric vehicles and traditional cars? The two technologies will co-exist for a while yet.

Recently, the atmosphere around electric vehicles has been buzzing with excitement. In 2016, global electric vehicle (EV) sales set a new record at 750,000 units. Meanwhile, in July 2017, Tesla finally unveiled the $35,000 Model 3, whose affordable price is designed to propel EVs into the consumer mainstream.

Established car manufacturers are furiously playing catch-up. Volvo has announced that all its new models from 2019 on will be equipped with electric motors, while Volkswagen is targeting annual sales of 2 million to 3 million electric cars—around one-quarter of its total—by 2025.

With air quality issues making headlines worldwide, governments are also getting in on the act. July 2017 saw France announce plans to ban the sale of gasoline and diesel vehicles by 2040. Just two weeks later the U.K. followed suit, only for China to reveal that it too was “studying” a similar ban in September.

No wonder, then, that headlines like “The Death of the Internal Combustion Engine” (The Economist) and “Electric Cars Reach a Tipping Point” (Bloomberg) are ubiquitous. The momentum behind EVs feels unstoppable.

Look Below the Surface

The reality, however, is somewhat more complex. After all, quite a few EV support-infrastructure issues still need to be resolved before mass acceptance of the technology. Are there enough charging points for millions of vehicles? Is charging itself fast enough to be practical? Can lithium batteries be fully recycled? Can the electricity grid cope with so much new demand? Will EVs become more affordable for consumers?

“In time, yes” is the answer to all the above questions. Perhaps, however, the most important question of all is this: When we look beyond zero tailpipe emissions to consider all the greenhouse gas emissions EVs produce, from indirect to direct energy inputs, are they actually cleaner than traditional fuel vehicles as things stand right now? Evaluating EVs in well-to-wheel, or life-cycle, terms flags some surprising results.

The International Energy Agency found that EVs do fulfill their promise of having lower CO2 emissions per kilometer than any other powertrain technology...in France. Why? Because France has an exceptionally low carbon grid. However, in countries that still depend more on electricity generated from fossil fuels the picture is very different.

Making EVs into a truly low—if not zero-emission—mode of transport is thus about much more than just producing electric cars. Ultimately, it will require nations to slowly shift their power generation infrastructure away from high-carbon fossil fuels to low-carbon alternatives like wind, solar, or nuclear.

Incremental and Transformational

Given the extent of the challenge, perhaps adopting a gradualist, best-of-both-worlds approach to the green mobility problem makes more sense, suggests Motoki Ebisu from the development group of Mitsubishi Heavy Industries Engine & Turbocharger (MHIET). That means making incremental improvements to traditional internal combustion engine-powered vehicles to make them competitive with EVs in emission terms well to wheel, while solving EVs’ own technological challenges.

Lightweight materials for the car body, low rolling-resistance tires, and stop-start systems are all examples of technologies that carmakers are deploying to boost the fuel economy—and the environmental performance—of traditional gasoline vehicles.

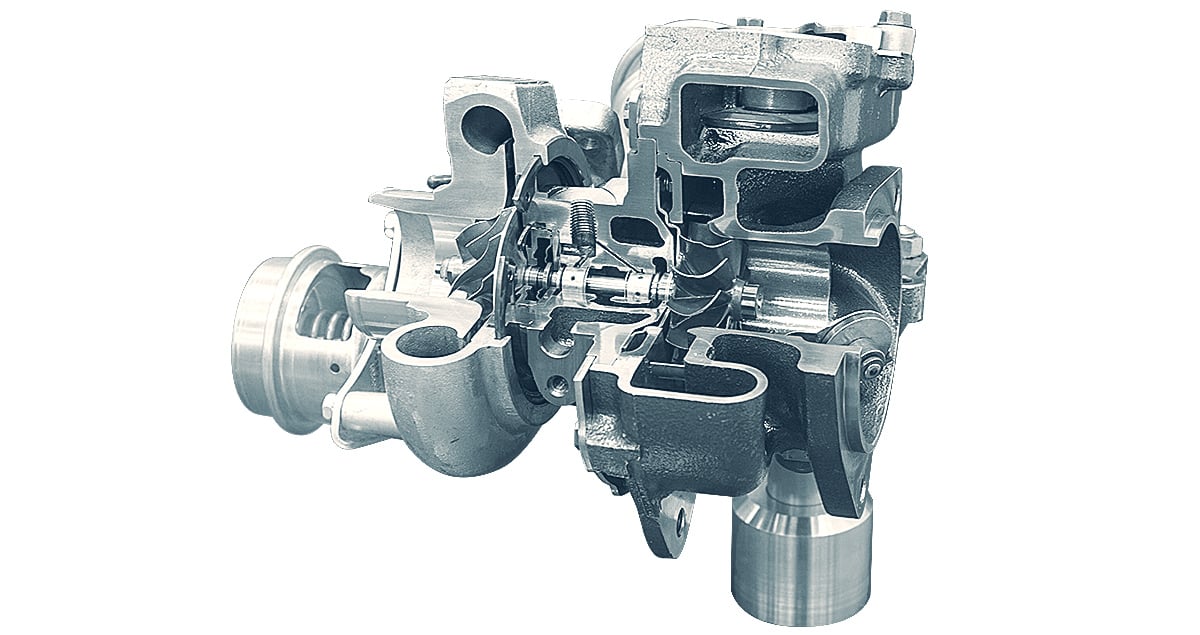

The turbochargers that MHIET manufactures are among the most effective of these technologies following a radical change in the auto industry’s thinking about turbochargers. “In the 20th century, turbochargers existed to boost the power of high-performance cars,” explains Tsuguhiro Nakamura, sales manager at MHIET. “Then, in the early 2000s, as governments began applying regulatory pressure, carmakers realized that turbochargers could also make engines smaller and more fuel-efficient.” The role of turbochargers was suddenly transformed: Now they deliver quietness and environmental friendliness, including fuel economy, to the many—rather than noise, thrills, and speed to the few.

A Large and Growing Market

Currently, 50% of all gasoline-powered vehicles feature turbochargers. But as governments around the world tighten regulations on fuel economy and emissions, that percentage looks set to head higher.

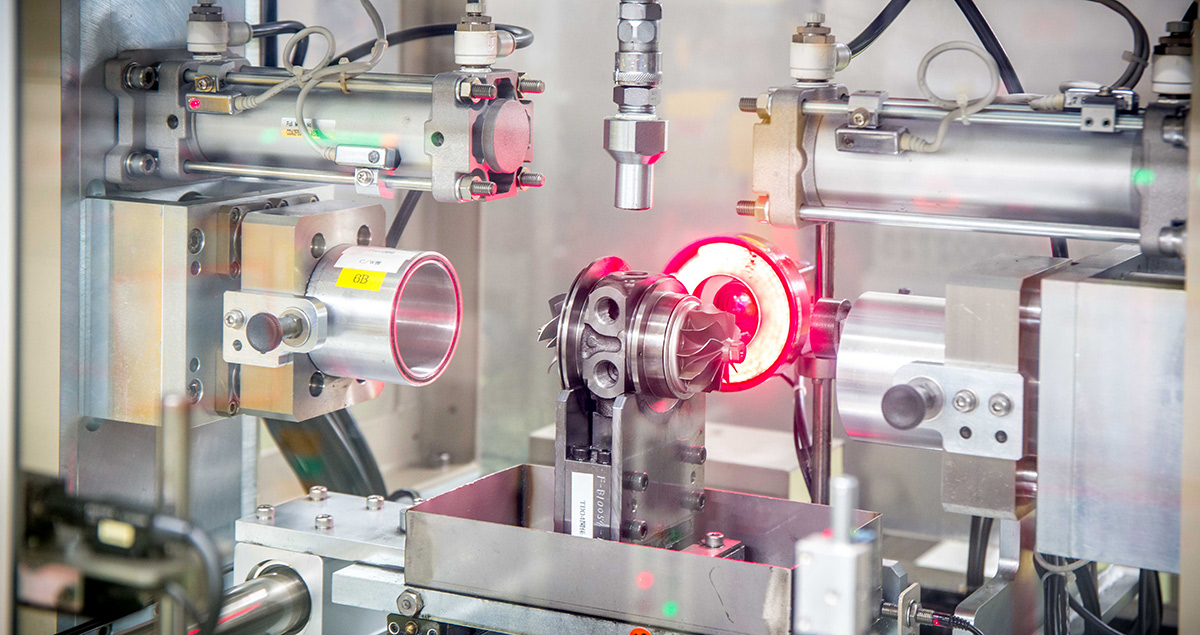

As one of the world’s top four turbocharger makers, MHIET is in a good position. In the year ending March 31, 2018, the company will produce 10 million turbochargers, or roughly one-quarter of total global passenger-car turbocharger output. The company has three competitive advantages. First, its parent company, Mitsubishi Heavy Industries Group, has decades of transferable expertise in high-speed rotational technologies, including gas turbines and jet engines. Second, thanks to complete automation of the production process, it can offer consistently high quality levels. Third, the company has global reach, manufacturing the turbocharger cartridges (the core rotating part of the turbocharger) in two factories in Asia before adding the turbine and compressor housings in final assembly plants close to its OEM customers in multiple locations worldwide. The company’s turbocharger division in the Netherlands covers everything from R&D to production and sales to all major European automotive makers.

Based on expert projections, MHIET expects the global market for gasoline-engine turbochargers to almost double between 2016 and 2023. Over the same period, sales of turbochargers for hybrids—still a nascent market—will increase to almost 30 times their present level. (Plug-in hybrids are counted as EVs, even though they contain an internal-combustion engine.) In geographical terms, meanwhile, the North American and Chinese turbocharger markets will almost triple in size, while demand from the rest of the world will nearly double as mass motorization takes off in emerging countries.

“We expect turbocharger demand to keep growing until around 2030 and hold steady for quite a while thereafter,” comments Nakamura.

Anticipating the Future Global Vehicle Market

While carmakers are set on focusing on electric vehicles for the long-term they also have a very pragmatic point of view. “We talk to all the global car manufacturers; they are confident that the internal-combustion engine will remain the mainstream powertrain medium-term,” says Ebisu. “Factor in CO2 emissions on a life-cycle basis and the internal-combustion engine is still a very effective powertrain—and one our turbochargers can keep making more efficient. The combustion engine’s future is brighter than people think.”