Driving forward decarbonization with Positive Impact Finance

To prevent global temperatures breaching the 1.5°C goal of the Paris Agreement will require $9 trillion of annual investment, the Climate Policy Initiative estimates.

This huge but essential investment will require a range of financing options. Positive Impact Finance (PIF)* loans are one example of this.

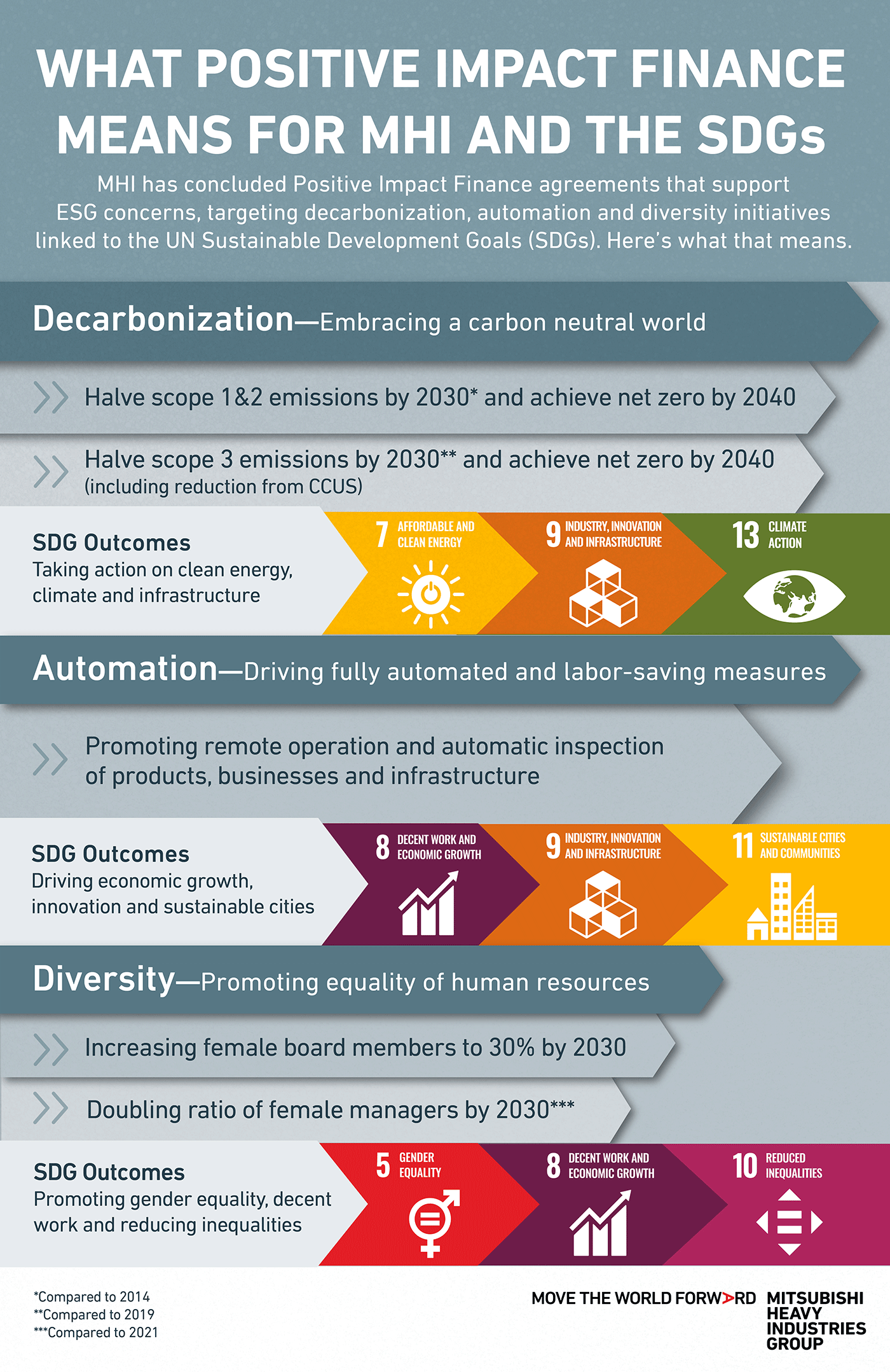

Mitsubishi Heavy Industries (MHI) has concluded such agreements with MUFG Bank in 2022, and with Nippon Life Insurance Company and Sumitomo Mitsui Trust Bank in 2024.

Take a look at this graphic to see MHI’s targets for decarbonization, automation and diversity, that are the basis of the 10 billion yen loan agreement with Sumitomo Mitsui Trust Bank and how those pledges align with the UN SDGs.

*PIF loans are intended to provide continuous support for corporate activities while comprehensively analyzing and evaluating the impacts (both positive and negative) those activities have on the environment, society, and the economy. The key feature of PIF is the use of the degree of contribution to achieving the SDGs through corporate activities, products, and services as an evaluation indicator, and monitoring based on disclosed information.

Discover more about MHI‘s positive impact finance