India’s Path to a Hydrogen-Powered Future

To reduce emissions, India must prioritize small steps towards decarbonization that yield rapid improvements without excessive capital expenditures. Success will position the country to tackle deeper emissions challenges and pave a path to net zero.

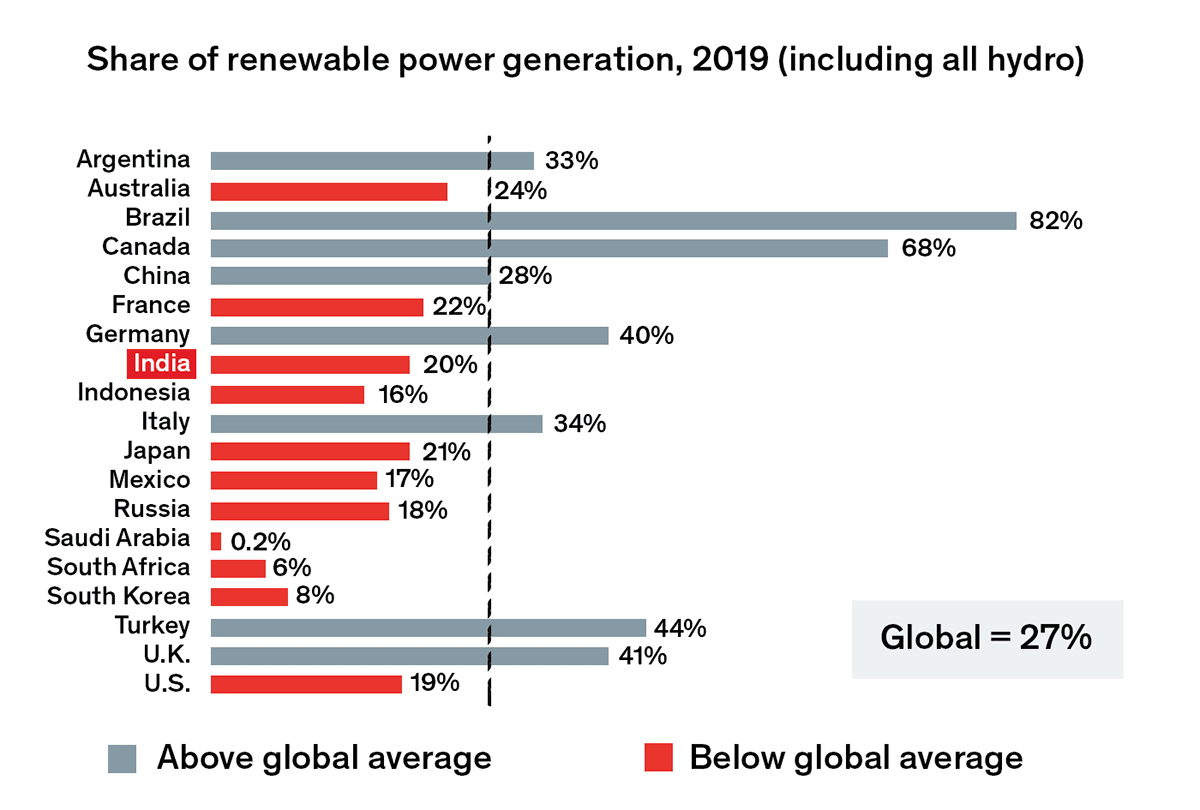

Today, India accounts for 6.7% of global greenhouse gas emissions. High-cost-driven imports including crude oil, natural gas and coal comprise over 80% of its total energy mix. And liquefied natural gas imports are forecast to triple by 2040. While the government’s policy-backed clean energy ambitions promise to reduce India’s reliance on emissions-intensive sources, achieving them will take time.

"India, Indonesia and most ASEAN countries are at the very beginning of the energy transition journey and still rely heavily on thermal power from oil and coal," Yoshiyuki Hanasawa, Executive Vice President, Chief Regional Officer for Asia Pacific and India at Mitsubishi Heavy Industries (MHI) wrote in an article, noting that there is a need in the short and medium term to "start the switch from coal to gas--and particularly liquid natural gas."

As gas and other fossil fuels continue to play a vital role in India's foreseeable future, interim transition technologies including upgrading for efficiency improvement and mix firing of carbon neutral biomass fuel with coal will help to limit emissions from traditional power sources, yielding progress while the country pursues its long-term target of achieving 450GW of renewable energy capacity by 2030.

Unlocking a Future with Hydrogen

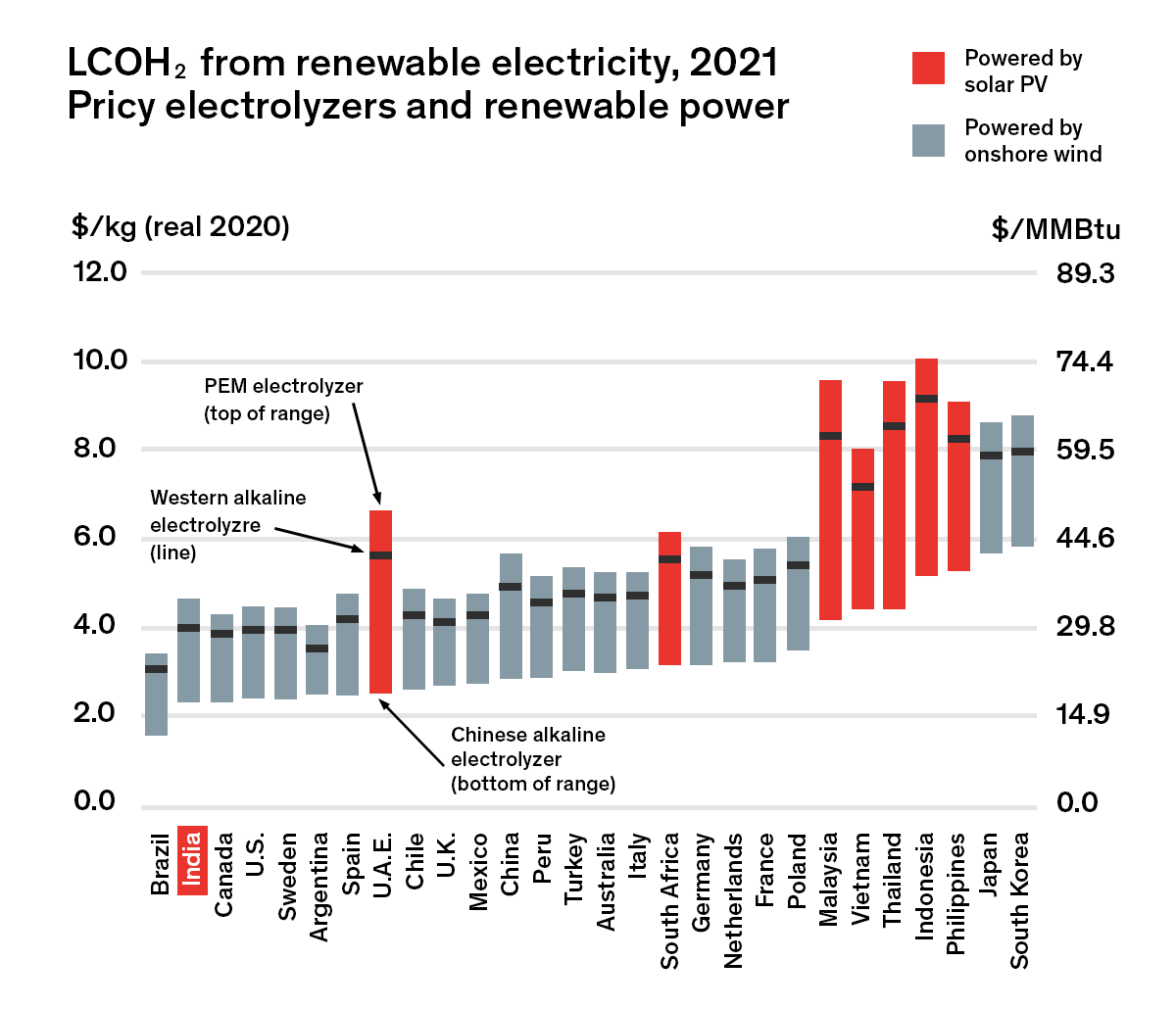

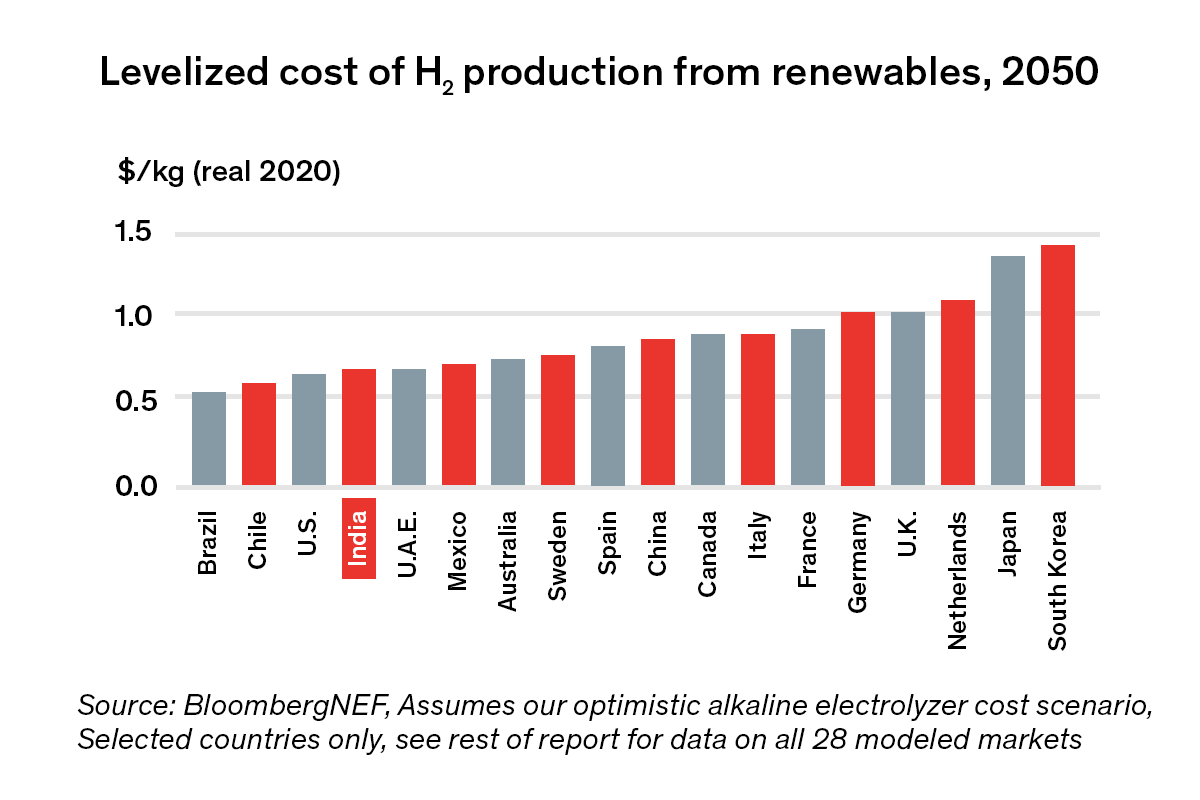

While it has not yet been commercially deployed in India, hydrogen will undoubtedly become part of the energy mix in the longer term. India can look to green hydrogen as a lower-cost, zero-pollution domestic alternative to imported LNG that has a wide range of applications.

"If India embraces hydrogen and other carbon-free fuels, it will increase domestic production and immediately reduce its carbon footprint," says Emmanouil Kakaras, Executive Vice President of MHI's NEXT Energy Business. "These are low-hanging fruits on the decarbonization trajectory that can make a step change very quickly."

That potential extends to the industrial sector. Steel, cement, chemicals, and other heavy industries account for roughly a quarter of India's greenhouse gas emissions. Already the world's second-largest steelmaker, India contributes 5% of global production. By 2050, it will account for nearly one-fifth. Hydrogen, ammonia and other clean fuels can accelerate decarbonization in steel and other hard-to-abate sectors that are critical for the economy.

"We can increase the direct mixture of hydrogen into natural gas and reduce the carbon footprint," Kakaras adds. "The beauty of that is that you can do it in existing coal plants and gas plants. The next logical step is to introduce ammonia for commercial applications. Hydrogen-based ammonia is a carbon neutral fuel, and we will have the technology for direct ammonia firing gas turbine from 2024 onwards."

India currently consumes around 6 million tons of hydrogen per year, predominantly for use in refineries and the synthesis of ammonia for fertilizers. Most of this is gray hydrogen. Production requires natural gas, which is expensive and doesn't address emissions without technologies like carbon capture. Overcoming this challenge is a much-needed first step.

"We have to start from decarbonizing hydrogen in the industrial scene," Kakaras says. "If we use a credible carbon management solution, it will become an enabler of the hydrogen economy. I'm confident that we will see a gradual cost down-curve that will allow a massive rollout of hydrogen in the next decade."

As the levelized cost of renewable energy in India decreases, green hydrogen will become cost competitive, and production will increase. In the medium term, advanced class heavy duty duel-fuel turbines including J-Series turbines from Mitsubishi Power could play a crucial role in reducing in reducing emissions.

Mitsubishi Power has been developing and using hydrogen-rich gas turbines for the cogeneration market since the 1970s. It aims to drive even larger hydrogen demand in the years ahead.

- Since 2015, Mitsubishi Power has been collaborating with Japan's New Energy and Industrial Technology Development Organization (NEDO) to develop hydrogen combustion technology for large-frame gas turbines that we expect will shape the future of power generation.

- In 2018, the company achieved stable combustion of a 30% hydrogen/70% natural gas fuel mix at 1,600°C using a J-series gas turbine combustor.

- Commercialization of large gas turbines with 30% hydrogen co-firing will be achieved in 2025 (Utah, U.S.A.), and commercialization of 100% hydrogen fuel firing is expected by 2030. Mitsubishi Power also plans to commercialize small and medium-sized gas turbines with 100% hydrogen-firing by 2025.

Kakaras adds. "Technology-wise, we're already there. We don't have to invent anything."

Increasing Political Support

Hydrogen is gaining much-needed political support. In October 2020, speaking at the India Energy Forum, the Prime Minister laid down India's energy map comprising seven key drivers. Among them was a pledge to move into emerging fuels including hydrogen.

Meanwhile, Union Budget 2021 in February suggested that India could get a new National Hydrogen Energy Mission this year with a focus on producing fuel using renewable energy or green hydrogen. The new mission would lay down a short-term strategy and broader policy principles for the next decade. That likely includes a mandate to use green hydrogen across energy-intensive industries like oil refining, fertilizers and steel.

India is already making progress. During the Hydrogen Economy: New Delhi Dialogue -- 2021, Union Petroleum and Natural Gas & Steel Minister Shri Dharmendra Pradhan said the government has taken various initiatives on the hydrogen front: "We are working on a pilot project on Blue Hydrogen, Hydrogen CNG (H-CNG) and Green Hydrogen. Through technological advancements, we are blending hydrogen with compressed natural gas for use as transportation fuel as well as an industrial input to refineries."

With a strong mandate and ample investment, hydrogen could completely change India's energy ecosystem and role as an energy importer over the next few decades.

"In the long term, there is a huge opportunity for India to become an energy exporter with renewable hydrogen," Kakaras says. "That will really bring costs down by having the cross-subsidy between the revenues of exporting green energy and the local consumption. This will contribute to India's energy independence."

Discover more about Technology innovation on the path to 2050